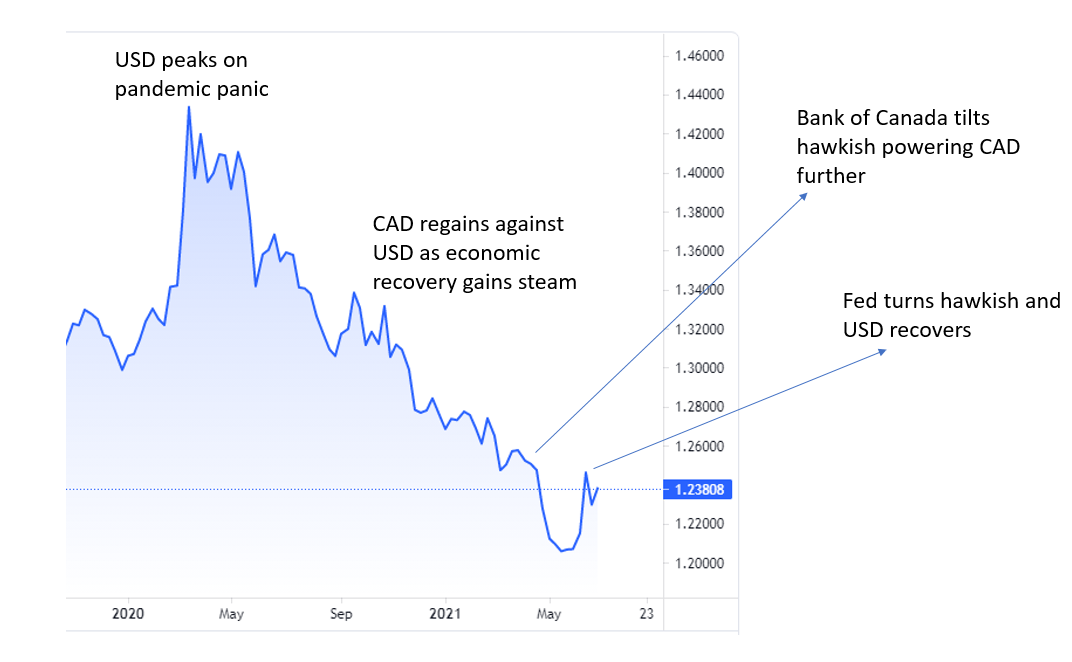

As we come to the end of the second quarter and the first half of the year, it makes sense to review how the Canadian dollar has performed so far in 2021. At the beginning of the pandemic in March of 2020, USD spiked to nearly a decade high against CAD as global panic led investors to the safety of the greenback. But by the beginning of 2021, the economic panic had subsided as central banks around the world injected enormous amounts of liquidity into the markets and governments provided unprecedented fiscal stimulus. By this point, the US dollar had retreated broadly and as the recovery began to take shape, the Canadian dollar was trading at approximately around its pre-pandemic levels. USD to CAD then remained roughly range-bound at between 1.250 and 1.280. On the one hand, the accelerating global recovery and multi-year highs pushed up the Loonie. On the other hand, the fear of inflation and the US central banks moving sooner than expected to rein in stimulus kept a lid on the value of the Canadian currency. Then in April, the Bank of Canada became the first major central bank to tilt hawkish and indicated rate hikes several quarters earlier than the market had priced in at that point. That propelled the Canadian dollar to its highest levels since 2017. At one point, the value of USD to CAD briefly traded as low as 1.200 (ie: that was the peak of the Canadian dollar). But in June, the US Federal Reserve had followed the Bank of Canada in messaging a more hawkish stance given the rapid economic recovery and the US dollar responded by gaining broadly, including the Canadian dollar. Where we are now is that the Canadian dollar is well below its peak in April but still trading well above where it was at the beginning of the 2021.